Intelligent NetZero Porfolio Analysis and Digital Assurance

InteNZ embeds environmental and climate risk analysis into the financial decision making for property investors. It combines property asset details with finance accounting information in a model that allows the implications of different scenarios related to net zero to be investigated.

InteNZ will use advanced accounting techniques to model these risks as discounts on future projected value of assets. This method turns softly qualified environmental risk into hard measurable impacts to a company’s balance sheet and future project revenues and costs.

In the UK, domestic properties account for 35% of all the energy used and emit 20% of the carbon dioxide emissions. The existing housing stock is old and therefore for the Government to deliver its Net Zero ambition by 2050 it will have to address domestic property emissions with a focus on the retrofitting of energy efficiency and low carbon measures to existing properties. Such measures might include improved insulation, replacement of gas boilers, solar panels and requirements to meet specific EPC standards, and will be achieved through a series of taxation, incentives and legislation changes on top of the requirements already announced.

In addition, increasing fuel costs and people’s expectations for homes to be warm and comfortable without damp and with access to fresh air means that there is more and more attention given to the environmental performance of properties by tenants and the market. Covid-19, and air borne pollution creates a tension between air flow and air quality as well as heat loss and gain. The problem is difficult to solve easily in a cold and damp maritime climate.

For private and social landlords the potential financial implications of these shifts is huge. The average cost of a retrofit is £30k for property and this is set to rise with tightening requirements and expectations. Investment in property, whether direct or indirect investment, represents one of the cornerstones of the financial industry. For such investments climate and environmental risks play an ever increasing role. For example:

Landlord costs

Cost of energy and building fabric retrofit to achieve environmental standards

Comparative costs

Comparative cost to developer for different build and energy strategies

Tenant costs

Long term cost to tenant

Future capital

Implications on future property value and rental income

Prioritisation

Opportunity cost of prioritising one retrofit over another

Legislations

Changing legislative landscape and scenario planning to anticipate the market

concept

risk modelling

InteNZ is built on accounting techniques and scenario planning tools that model the risks and discounts the future projected value of assets. It examines the costs and looks at the implication of each decision. For any given net zero obligation it will determine which properties are affected, what the options for compliance are and the financial implications of retrofit, property values, future costs and revenue. The method therefore turns qualified environmental risks into hard measurable impacts to a company’s balance sheet.

scenario analysis

InteNZ is a scenario analysis tool that enables examination of the financial implications of different Net Zero options. It is a complex area with risks ranging from fiscal and compliance measures, to habitation trends. The return on investment for current and future property investment is therefore highly dependent on government policy, market performance, technology innovation and the needs and wants of the people who live in them.

data fusion

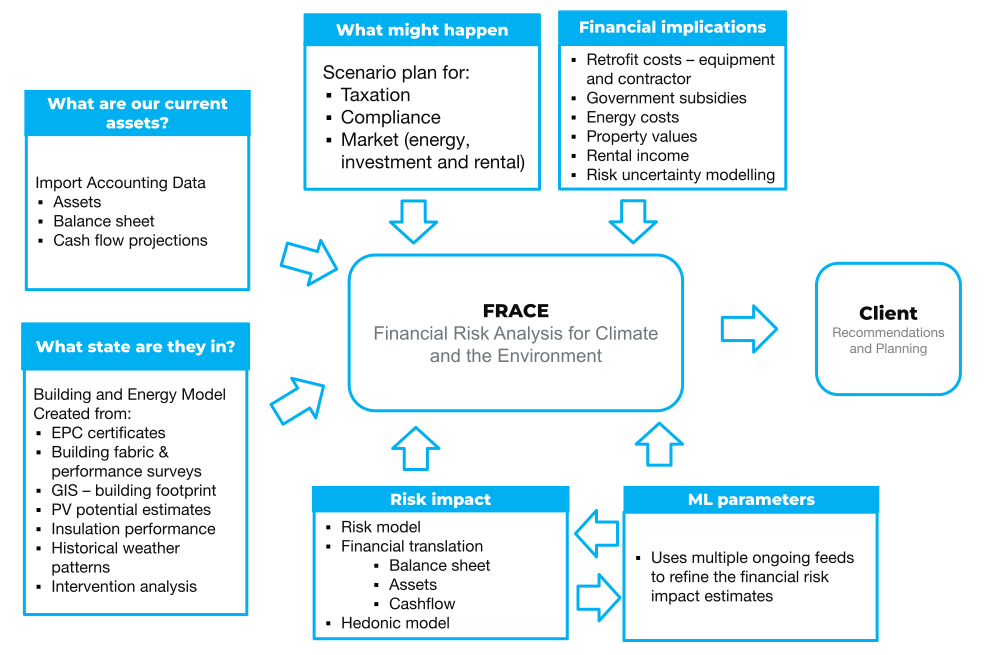

InteNZ combines the following data sources and elements:

- Current asset data imported from accounting information including asset values and cash flow projections

- Building and energy performance data such as EPC certificates, surveys, mapping data, energy usage, open data

- Scenario options – changes to taxation, compliance requirements, market pressures

- Financial implications – including retrofit costs and efficacies, subsidies, energy costs, property values and rental income

- Risk model – examines the impact on balance sheet and cash flow

domain experts

The technology combines solutions that have been tried and tested in similar uses including an AI powered financial audit tool for extraction and deep accounts analysis, a scenario planner for real estate used by several local authorities and an energy and building stock modeller developed by the University of Southampton that examines building refit options.

how to get involved?

We are looking to work with large social housing bodies to make FRACE a working net zero tool that will scenario plan and aid decisions for retrofitting and improving housing stock to meet the Net Zero Challenge.

We are looking to work with a handful of large scale public sector landlords to help develop the system. We will require access to key staff who understand the problem and are engaged to produce a solution that meets their needs. For this they will have the opportunity to shape the tools for their requirements and trial the system using their own portfolio data.

For more information or to get in touch please contact info@nqminds.com