intelligent system to implement financial audit and intelligent sampling regimes

TDX financial audit analytics is an intelligent, financial analytics platform that implements data-driven audit processes to achieve true efficiencies in the audit workflow. A modular approach allows the software to take advantage of both traditional statistical tools and more advanced algorithms, including artificial intelligence and machine learning, in an integrated fashion.

core benefits

Secure

Privacy

Workflow Improvements

Reduce auditors time by using smart process to autofill and autocorrect critical feels.

Deep Analysis

Deep and holistic analysis of all transitions, allowing for compressive statistics to be generate.

Fraud Detection

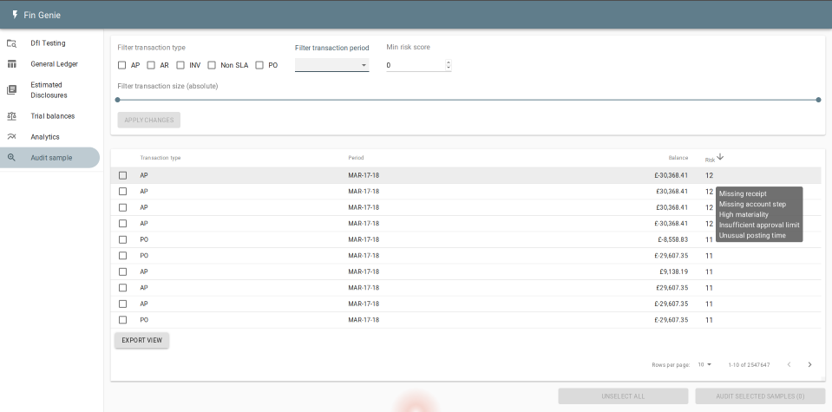

Dynamic detection of fraud using advanced anomaly detection algorithms.

AI Integration

Unique concept of AI integrated workflow that bridges the domain of analytics and operations.

features

Automating key tasks within the audit workflow will enable auditors to conduct more in-depth investigations and have more confidence in the representatives of their sample scheme. The assurances module focuses on creating efficiencies through the automation of tasks such as general ledger-trial balance reconciliation, and account disclosures.

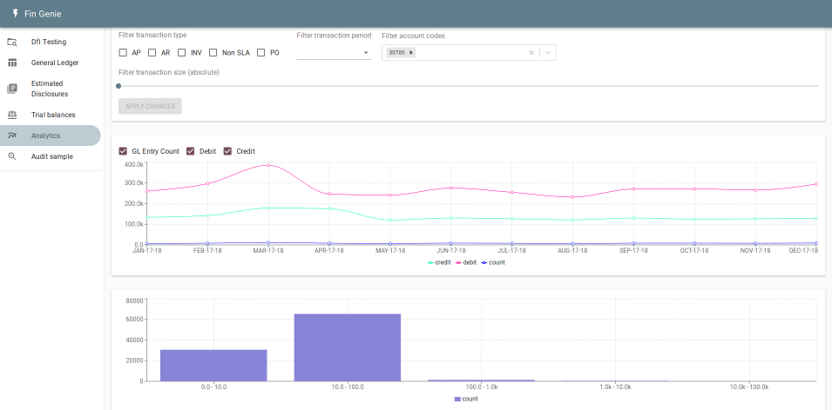

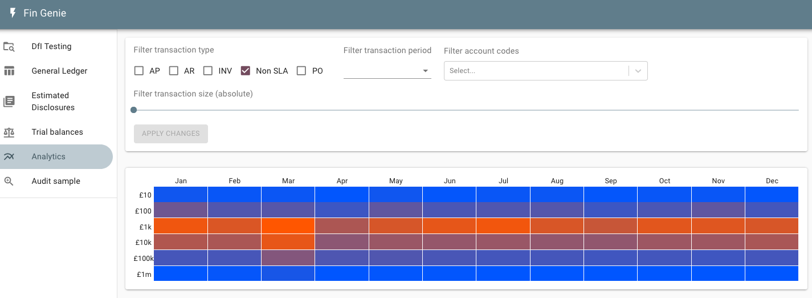

Normalised, quantised characterisation matrices provide methods of identifying transaction outliers against a context specific distribution. This methodology is useful for clustering and making comparisons between transaction families. Plots can be viewed as distribution against time or value dimension.

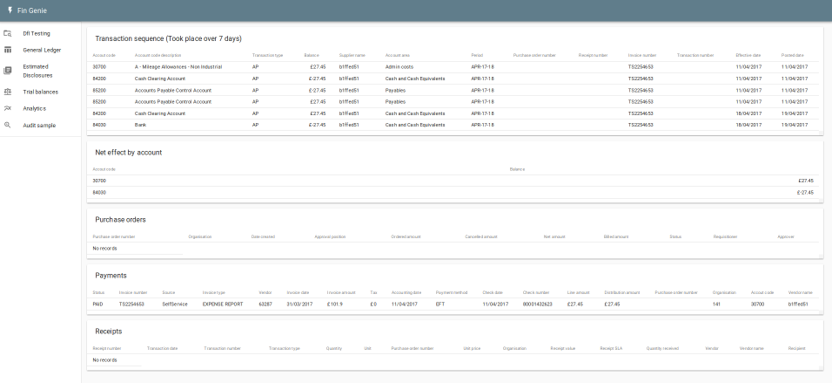

The automatic construction of general ledger workflow provides auditors with a new dimension of analysis. Classifying and identifying related general ledger entries into complete transaction chains, it is possible to enable new analytical methods to be applied to the audit process as well as improving existing methods. This will result in increased confidence that the select sample is representative of the full set of transactions, a key benefit of applying new techniques to audit. This methodology gives the potential for a holistic analysis of “partial” transaction integrity.